Please insert Non-Registrant No. LAST DATE TO FURNISH THE SST-02 RETURN 21.

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

2nd Taxable Period 1st November to 31st December 2018 Two months and so on.

. However the first taxable period of one company may differ from another. The return can be submitted through. I User Manual for Online Return and Payment Submission.

CUKAI PERKHIDMATAN SERVICE TAX. The manual guide covered topics of below. 48 rows SST-02 Form.

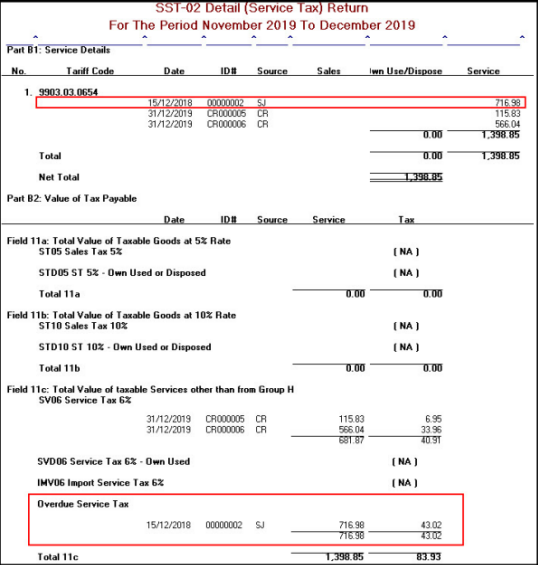

The return must be submitted regardless of whether there is any tax to be paid or not. New checkbox in SST02 SummaryDetail Report Finishing Tab. The user requires to declare any outstanding service tax after 12 months from the date of Invoice.

Companies have to declare SST return SST-01 every 2 months bi-monthly according to the taxable period. To submit your SST return first you need to confirm your taxable period. SQL - SST Listing 106.

Ad Weve filed over 50 Milllion Tax Returns with the IRS. Where a registered persons taxable period does not end on the last day of the month the SST-02 return should be furnished no later than the last day of the. EVEN FYE Months 1st First Taxable Period 2 month.

675 views 8 likes 1 loves 1 comments 13 shares Facebook Watch Videos from Full Hos. Select the settlement period. The payment can be made by bank.

Alternatively you can download Form SST-02 from the MySST portal and mail it to CPCCustoms Processing Centre by post. Ii How to Submit Online Return and Payment. You must submit your Tax Return electronically via httpsmysstcustomsgovmy and payments can be made after.

Select the report. Select the from date. I User Manual Registration Click Here.

To view Sales Tax License Information and Sales Tax Return Schedule. SST return has to be submitted not later than the last day of the following month after the taxable period ended. After the return submission in the same portal the payment is made via FPX facility with 17 banks to choose from.

如何呈报服务税SST-02报表 How to submit SST-02 Service. Ii How to Apply Online for Registration Sales Tax Or Service Tax Video Link Click Here. A SST Supervisor Card is required if you serve as the competent person as specified by Section 33011312 of the New York City Building Code.

New checkbox Include Overdue Invoices Since 1-Sep-2018 added to allow users to capture past overdue invoices from SST effective date 1 st Sept 2018 onwards. Guidelines Sales Tax Service Tax Return SST-02 Click. As mentioned earlier in this article all companies will follow a 2 months taxable period.

There are two ways to file the SST return. Online Payment a Procedure to Login Return Payment. From Simple to Advanced Taxes.

I Butiran 1 dan 2 Pembelian Pengimportan Bahan Mentah Komponen Bahan Bungkusan dan Pembungkusan Yang Dikecualikan Cukai Jualan. For submitting the Service Tax return in a prescribed form SST-02 and make Service Tax payments under the Service Tax Act 2018. Do note that the SST-02 Report should be furnished even though there is.

2nd Taxable Period 1st October to 30th November 2018 Two months and so on. In order to submit the SST submission please refer as below. SST-02A Form Service Tax Declaration By Other Than Registered Person Click Here.

Quickly Prepare and File Your 2021 Tax Return. Companies will need to submit SST return by the end of your taxable period. The SST return is required to be furnished to the DG no later than the last day of the month following the end of the taxable period.

You need to submit your Tax Return online via the CJP system. Select the sales tax payment version and then select OK to save your changes. This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

675 views 8 likes 1 loves 1 comments 13 shares Facebook Watch Videos from Full Hos Solution Sdn Bhd. Generate an SST-02 return form report Go to Tax Declarations Sales tax Report sales tax for settlement period or Settle and post sales tax. SST02 Form - guide on sales service tax SST Listing.

How to submit SST-02 Service Tax via MySST 010. Item 1 and 2 Purchase Importation of Raw Material Components Packing and Packaging Materials Exempted From Sales Tax. Once you have generated the SST-02 Report you will have to file the report manually by posting it to the Customs Processing Center CPC or submit the report via MySST Portal.

Once you have generated the SST-02 Report you will have to file the report manually by posting it to the Customs Processing Center CPC or submit the report via MySST Portal. To Submit Sales Tax Return.

Sst 02 Summary Detail Report Service Tax Overdue Abss Support

Sst02 Form Guide On Sales Service Tax Sst Listing Youtube

Sst Return Sst 02 Service Tax Help

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

如何呈报服务税sst 02报表 How To Submit Sst 02 Service Tax Via Mysst 0 10 Sql Sst Listing 1 06 Mysst Portal Submission 5 06 Check Past Service Tax By 1 Management Systems Cloud

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

Sales Tax 2 0 Mysst Submission Mandarin Youtube

Bryan Cheong Sst 02 And Sst Tax Code English Teaching Youtube

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog